Introduction NCDEX

In the vast realm of financial markets, the National Commodity and Derivatives Exchange, or NCDEX, stands as a crucial player, offering a unique avenue for investors to engage with commodities. Established in 2003, NCDEX has emerged as a prominent platform for trading in a wide array of agricultural and non-agricultural commodities, providing participants with opportunities to hedge against price volatility, speculate on market movements, and diversify their investment portfolios.

The Evolution of NCDEX:

NCDEX was founded with the vision of creating a transparent and efficient market for commodity trading in India. Over the years, it has played a pivotal role in transforming the landscape of commodity exchanges in the country. The exchange facilitates trading in various commodity derivatives, including agricultural staples like wheat, soybeans, and sugar, as well as non-agricultural commodities such as metals and energy products.

Key Features of NCDEX:

Comprehensive Product Range:

- NCDEX offers a diverse range of commodity contracts, catering to the varied needs of market participants. From agricultural commodities like chana (chickpea) and jeera (cumin) to non-agricultural commodities such as gold and silver, the exchange provides a platform for trading in an extensive array of products.

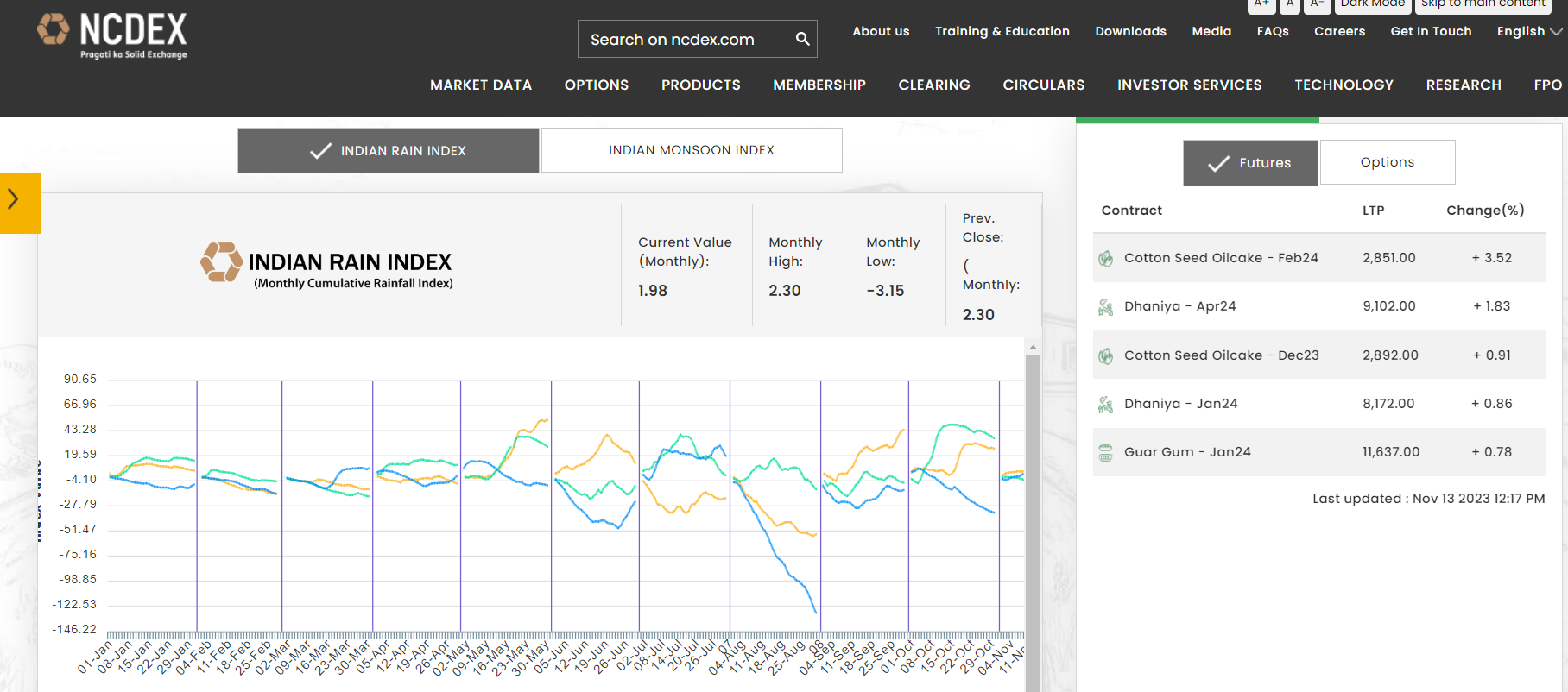

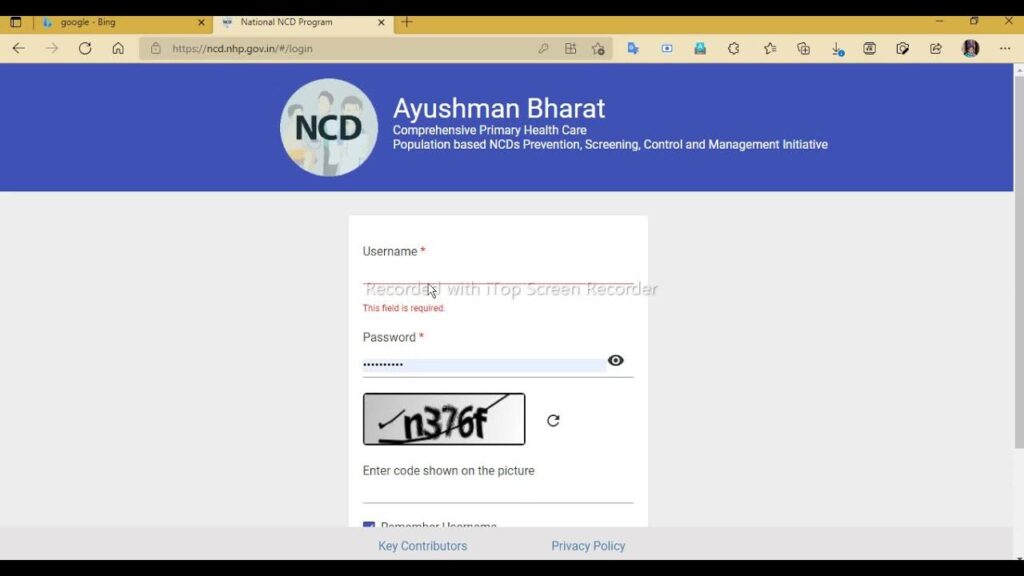

Technology-Driven Infrastructure:

- NCDEX leverages advanced technological infrastructure to ensure seamless and efficient trading. The use of cutting-edge systems not only enhances the speed and accuracy of transactions but also contributes to maintaining the integrity and reliability of the exchange.

Risk Management Mechanisms:

- Commodity markets are inherently susceptible to price fluctuations. NCDEX has implemented robust risk management systems to mitigate the potential risks associated with commodity trading. This includes margin requirements, position limits, and real-time monitoring of market activities.

Market Education Initiatives:

- Recognizing the importance of educating market participants, NCDEX actively engages in initiatives to enhance awareness and understanding of commodity markets. Educational programs, workshops, and informational resources are designed to empower traders and investors, enabling them to make informed decisions.

Regulatory Compliance:

- NCDEX operates within the regulatory framework set by the Securities and Exchange Board of India (SEBI). Adhering to stringent regulatory standards ensures the protection of investors and the overall integrity of the exchange.

Benefits of Trading on NCDEX:

Diversification Opportunities:

- Commodities often exhibit a low correlation with traditional asset classes like stocks and bonds. Trading on NCDEX allows investors to diversify their portfolios, potentially reducing overall portfolio risk.

Hedging Against Price Volatility:

- Farmers, producers, and other stakeholders in the commodity value chain can use NCDEX to hedge against the inherent volatility in commodity prices. This risk management tool provides a level of financial security amid fluctuating market conditions.

Speculative Trading:

- Traders looking to capitalize on short-term price movements find NCDEX to be a fertile ground for speculative opportunities. The availability of leverage further amplifies the potential returns, albeit with increased risk.

Contribution to Price Discovery:

- The trading activities on NCDEX contribute to the process of price discovery in the commodity markets. Transparent and efficient price formation is essential for all participants in the supply chain, from farmers to end consumers.

Challenges and Opportunities:

While NCDEX has significantly contributed to the development of commodity markets in India, it faces challenges that are inherent to the dynamics of commodity trading. Price volatility, global market trends, and regulatory changes are some of the factors that can impact the performance of the exchange.

However, these challenges also present opportunities for growth and innovation. Continuous technological advancements, expanded product offerings, and increased participation from institutional investors are avenues through which NCDEX can enhance its position in the market.

Market Trends and Outlook:

As we delve deeper into the dynamics of NCDEX, it is essential to explore the prevailing market trends and the outlook for the future. One notable trend is the increasing integration of technology, such as algorithmic trading and mobile applications, in facilitating easier access for retail investors. This technological evolution is not only enhancing the efficiency of trade execution but is also broadening the market by attracting a more diverse set of participants.

Moreover, the advent of commodity exchange-traded funds (ETFs) on NCDEX has provided investors with another avenue to gain exposure to commodities. These investment vehicles, which track the performance of commodity indices, offer a convenient and liquid way for both retail and institutional investors to include commodities in their portfolios.

The outlook for NCDEX appears promising, considering the growing recognition of commodities as an asset class and the increasing need for risk management tools in the face of global economic uncertainties. The exchange’s strategic initiatives, such as the introduction of new products and ongoing efforts in investor education, position it well for continued growth and relevance in the financial markets.

Global Integration and Challenges:

While NCDEX primarily operates within the Indian market, it is not immune to global economic factors. The interconnectedness of global markets means that events in international economies can have a ripple effect on commodity prices, influencing trading activities on NCDEX. As a result, the exchange must navigate the challenges posed by geopolitical events, supply chain disruptions, and fluctuations in currency values.

Furthermore, the integration of NCDEX with global commodity markets opens up opportunities for international investors to participate in India’s commodity landscape. This globalization can bring in diverse perspectives and trading strategies, contributing to the overall vibrancy and liquidity of the exchange.

However, with this global integration comes the challenge of aligning with international standards and regulations. NCDEX must remain vigilant in adapting to evolving global norms while ensuring compliance with domestic regulatory requirements to maintain the integrity and trust of market participants.

Social Impact and Sustainability:

Beyond its role as a financial marketplace, NCDEX has a social impact by directly affecting the livelihoods of those involved in agriculture and related industries. The exchange contributes to fair price discovery, providing farmers with a platform to hedge against market uncertainties and secure a more stable income.

In the context of sustainability, NCDEX can play a pivotal role in promoting responsible and sustainable practices in commodity production. The exchange can collaborate with stakeholders to encourage environmentally friendly and socially responsible initiatives, fostering a more sustainable and resilient commodity ecosystem.

Innovation and Technological Advancements:

One of the driving forces behind NCDEX’s sustained relevance is its commitment to innovation and technological advancements. The exchange has consistently embraced new technologies to enhance trading infrastructure, improve efficiency, and provide a seamless experience for market participants. The integration of blockchain technology, for instance, can further enhance transparency, security, and traceability within the commodity trading ecosystem. This ongoing commitment to innovation positions NCDEX at the forefront of the ever-evolving financial landscape.

Moreover, the rise of data analytics and artificial intelligence has the potential to revolutionize commodity trading. NCDEX can leverage these tools to gain insights into market trends, assess risk more effectively, and provide valuable information to market participants. By harnessing the power of data, the exchange can enhance decision-making processes and offer tailored solutions to meet the diverse needs of traders, investors, and other stakeholders.

Role in Economic Development:

Beyond its immediate impact on commodity markets, NCDEX plays a crucial role in the broader economic development of the country. The exchange facilitates capital formation, supports agricultural and industrial sectors, and contributes to overall economic growth. By providing a platform for efficient price discovery and risk management, NCDEX empowers businesses, particularly in the agriculture sector, to make informed decisions and plan for the future.

Furthermore, the availability of commodity derivatives on NCDEX can attract foreign investment, fostering economic globalization and creating a more interconnected financial ecosystem. As India continues to position itself as a global economic player, NCDEX’s role in attracting international investors and facilitating cross-border transactions becomes increasingly significant.

Regulatory Landscape and Investor Confidence:

The regulatory environment in which NCDEX operates is a cornerstone of its success. Stringent regulatory oversight, particularly by the Securities and Exchange Board of India (SEBI), ensures market integrity, investor protection, and fair practices. NCDEX’s adherence to regulatory standards not only instills confidence among market participants but also contributes to the overall credibility of India’s financial markets.

However, the evolving regulatory landscape presents both challenges and opportunities. Striking the right balance between investor protection and market innovation is crucial. By actively engaging with regulators and proactively adapting to regulatory changes, NCDEX can foster an environment that encourages responsible trading practices while allowing for the continued growth and development of the commodity market.

Community Engagement and Corporate Social Responsibility:

NCDEX’s commitment to corporate social responsibility (CSR) and community engagement is an integral aspect of its identity. The exchange can actively participate in initiatives that benefit the communities it serves. This could include supporting agricultural education programs, promoting sustainable farming practices, and investing in initiatives that uplift rural communities.

By aligning its operations with social and environmental responsibility, NCDEX can enhance its reputation as a socially conscious institution. This not only contributes to the overall well-being of society but also resonates positively with investors and stakeholders who increasingly prioritize ethical and sustainable business practices.

Final Thoughts:

In the ever-evolving landscape of financial markets, NCDEX remains a dynamic force, continually adapting to new challenges and opportunities. Its multifaceted impact on commodity trading, economic development, technological innovation, and social responsibility underscores its significance in shaping India’s financial future.

As NCDEX charts its course forward, the exchange must remain agile, responsive, and forward-thinking. By embracing innovation, fostering community engagement, and navigating regulatory landscapes with prudence, NCDEX is poised to continue its pivotal role in shaping the destiny of India’s commodity markets for years to come.